Options and futures both belong to the category of financial instruments known as derivatives. A derivative is understood to be an instrument, the price that is determined by the value of some asset class. Derivatives can be purchased for a wide variety of assets, including stocks, indexes, cryptocurrency, platinum, silver, wheat, wool, gasoline, and other commodities and products. To summarize, a derivative could be attached to virtually any type of economic instrument or asset that could be purchased or sold. Here we will discuss the futures and options and know the major differences-

Futures Vs Options

The commitment that is transferred to you since you buy futures as opposed to the obligation that you take on when you buy options is what differentiates the two. Both Futures and Options are monetary contracts that you would open for trading on several different exchanges. You must complete the entire settlement of your trade using futures. However, if you trade with options, you can decide not to and instead pay the premium, which is also referred to as the investment or the margin.

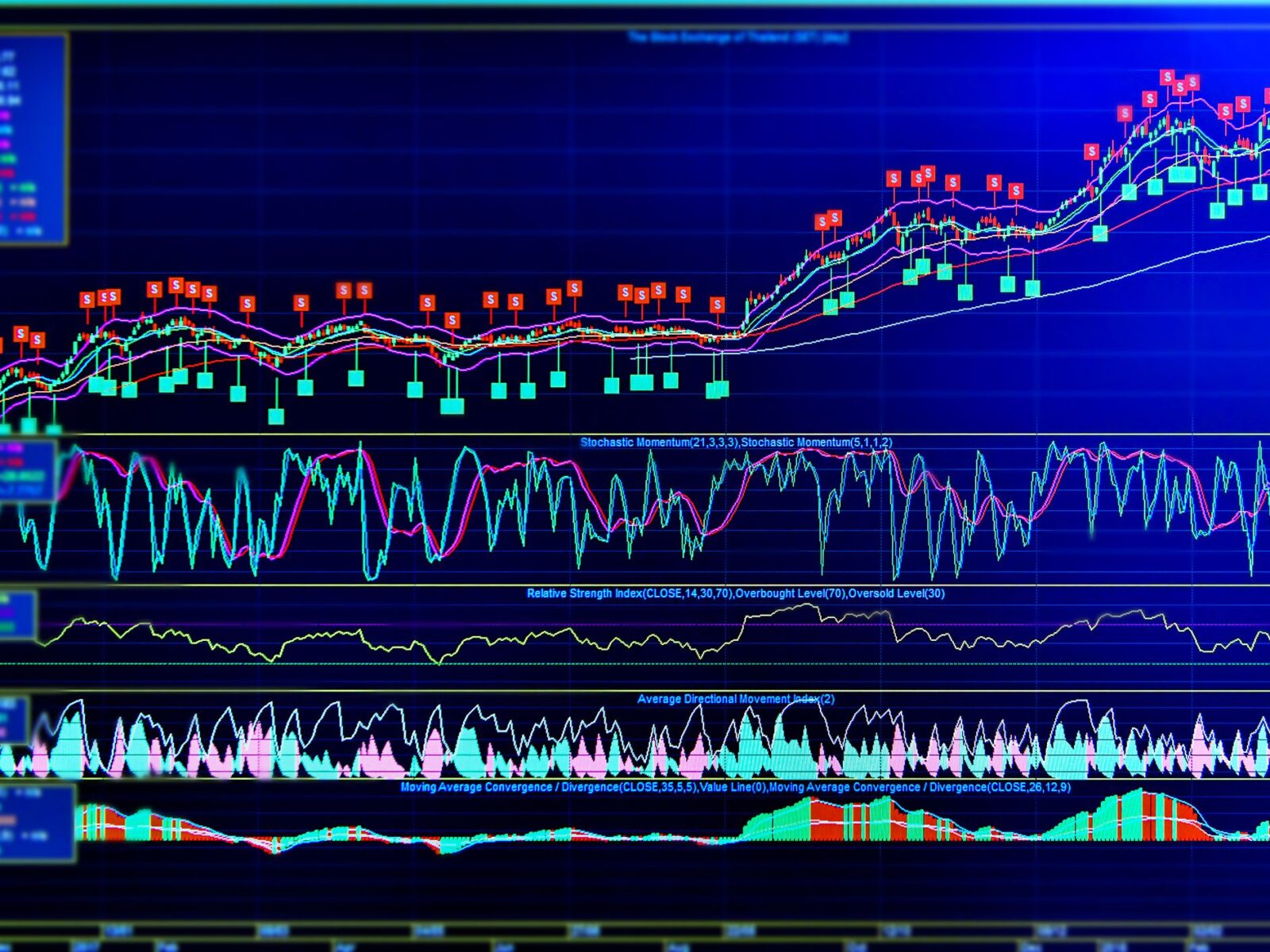

Price and liquidity

Since options contracts can only fluctuate about the underlying futures contract, the movement of futures contracts occurs much more swiftly than options contract movement. This sum may be as high as 50% for options that are trading right at the money, or it might be as low as 10% for options that are trading well away from the money. There is no need for you to be concerned about the steady loss in value that options are susceptible to experiencing over time. These are important factors when discussing futures vs options.

The value of an asset that is spent on futures options is negative. To phrase it another way, the value of options decreases with the passage of each passing day. This phenomenon is referred to as time decay, and it has the tendency to become more pronounced as the expiration date of an option draws nearer. Being correct about the path the trade will take but having your options expire worthless nonetheless because the marketplace didn’t move sufficiently much to negate the effect of time decay can be a painful experience.

Risk

The danger associated with trading options, on the other hand, is far lower than the risk associated with trading futures. This is because the greatest amount of loss that may be incurred by the buyer of such an option is equal to the premium, as well as the contract does not become liquidated in just about any way. In the case of a futures contract, the fact that the buyer is compelled to buy or sell the actual asset means that should the trade not turn in their favor, this could result in enormous losses.

Advance payment

While investing in a futures contract, you will not be required to pay any upfront fees. However, the purchaser is obligated to pay the price that was initially agreed for the item in the future.

A premium is anything that needs to be paid when purchasing an options contract by the buyer. The purchaser of options is given the right, in exchange for payment of this premium, to defer the purchase of the underlying asset in the future if they believe it will be less appealing at that time. The amount that the owner of the options contract stands to lose is equal to the amount that was paid for the premium if the owner of the options contract decides to just not purchase the asset.

Whenever it comes to futures vs options, both are somewhat comparable in several respects, they are typically employed for a variety of distinct functions. The majority of active investors who wish to profit from up or down changes in the market will use a futures contract as their choice of instrument because it offers the most flexibility.